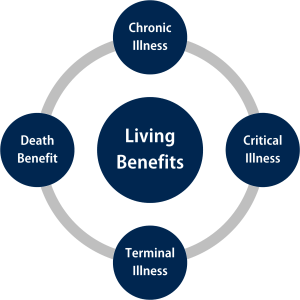

In our line of work, we spend a lot of time traveling around the country, talking about the numerous and wonderful advantages of having Living Benefit riders (Critical, Chronic, and Terminal Illness) automatically included on every life insurance policy that Alliance Group partners sell. However, there is one particular application of these Living Benefit riders, usually glossed-over, that is being thrust into the forefront as the result of some recent advancements that are being made on the cancer-fighting front.

Have you heard of this new CAR-T cancer treatment? If not, you have my permission to stop reading this and go Google it (as long as you promise to come back here once you’re done). Oncology researchers say this groundbreaking cellular immunotherapy is a cure for certain types of leukemia, lymphoma, and possibly several other types of cancer. They’re actually using the “c”-word. “Cure”. That’s not a word oncologists throw around very often, because most cancer treatments fail to live up to their promise. But in late-stage clinical trials, this treatment is showing results in cancer patients that researchers have simply not previously seen. This is huge.

There’s just one problem: virtually nobody can afford it.

The price tag on the newly approved Novartis CAR-T treatment tips the scales at a whopping $475,000. Developers cite the complicated and delicate process, which is custom-made for each patient, as the primary reason for that astronomical number.

And, as with any brand-new cutting-edge treatment you’ll find, this is still considered to be experimental, and as such, is not covered by health insurance.

This poses a huge problem to the vast majority of Americans who don’t have the spare $475,000 lying around to spend on this treatment if they were in need of the best option available to treat a sudden cancer diagnosis. For those people, financial limitations render this treatment off the table and out of reach, and they’re left with the options that their health insurance company will cover. Unfortunately, that is probably going to mean chemotherapy, radiation, and other conventional treatments. As you’ve probably seen from personal experience with stricken loved ones, these treatments can be extremely grueling, painful, and may not provide the best chance for a cure, while severely impacting a patient’s quality of life.

That’s not the kind of situation that we want – or our clients to be in. Luckily, there’s a way to prevent you, your family, or your clients from falling into this predicament: Owning (and helping your clients own) a life insurance plan that includes Living Benefits.

Utilizing the Living Benefit riders on their life insurance policy, a person could exercise the Critical Illness rider to accelerate a lump sum of money from their death benefit and get the money in their hands to fund this treatment (or other, newer experimental treatments that may come along in the future).

This is just the latest, greatest example of how Living Benefits can be used to circumnavigate the potentially crippling problems that life can throw at any given person at any given time.

Moral of the story: Living Benefits are no longer a luxury – they’re an absolute necessity, and if you’re serious about protecting your clients’ best interests, you need to get serious about making sure that the policies you’re recommending carry Living Benefits riders.