The Sovann Family

After narrowly escaping the Killing Fields of Cambodia as young adults, Nancy and Brian Sovann were incredibly fortunate to come to the United States, where they started a new life together.

Little did they know, the life they built for themselves in America would be threatened once again years later, when Brian suffered a stroke. As a result, he was hospital-bound for over 20 days. Both of their incomes dropped to zero as Nancy was forced to stop working to care for her husband. The bills were piling up, and Nancy was pushed to the brink of filing for bankruptcy.

Cornelia Steinberg

Cornelia Steinberg didn’t think she needed life insurance.

Her ex-husband earned good money in his job, and she figured that if anything ever happened to her, her daughter would be well taken care of.

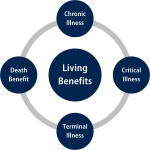

However, once Cornelia’s friend and adviser explained the reasons that owning Living Benefits life insurance made sense for her, Cornelia immediately saw the value as a “no-brainer”. A few months later, that decision proved to be, as she says in the video, one of the best she’s ever made.

Joelma Dias

Joelma Dias wasn’t convinced she was having a stroke.

During a fun night of hanging out with her friends at church, the right side of her body suddenly began to feel weak. Joelma felt fine otherwise, and insisted that she was going to head home and get some rest. Luckily, a friend of hers convinced her to go to the hospital instead, where she learned she had suffered a life-threatening stroke.

Heilyn Hernadez Pages (En Espanol)

Como ya se lo hemos mensionado en algunos de nuestors correos electrónicos anteriores, el seguro de vida con Beneficios Acelerados, le permite a los asegurados acceder a su beneficio de muerte mientras está vivo, o si se enferman o se lesionan críticamente.

Hoy quiero compartir con ustedes la increíble historia de Heilyn Hernández Pages. La vida de Heilyn cambio para siempre, un fatídico Lunes por la mañana cuando fue atacada en el estacionamiento de su trabajo. En un hecho espantoso, el atacante rocio con gasolina a Heilyn y la prendió en llamas. Sin embargo ella fue muy afortunada de sobrevivir!

Heilyn Hernandez Pages

Brutally attacked at her place of employment as she pulled into work one Monday morning, Heilyn Hernandez Pages was doused in gasoline and set on fire. The attack left her with severe burns covering the majority of her body.

Heilyn’s miraculous road to recovery would prove to be a costly one, requiring multiple graft surgeries and occupational therapy to regain full mobility. She was unable to work while in the hospital, and her income dropped to zero. As the sole provider to her household, which includes her young daughter and both of her parents, Heilyn was able to avoid financial ruin by accelerating $425,000 from her Living Benefits term policy. As fate would have it, she had set the policy up only nine months before the attack took place.

Carlos Navas

Cuando Carlos Navas sufrió un ataque al corazón imprevisto, su tratamiento y recuperación lo mantuvieron fuera del trabajo durante cuatro meses. Afortunadamente, el nuevo tipo de seguro de vida, que incluye beneficios durante la vida. Al acelerar el beneficio de la muerte de su póliza, Carlos fue capaz de obtener dinero crucial en sus manos cuando mas lo necesitaba.

Mira como Carlos y su esposa Clara comparte su historia de cómo Beneficios en Vida salvaron a su familia de un desastre financiero.

Elizabeth Martinez Genova

Elizabeth Martinez Genova was busy living her life to the fullest. She had served in the military, graduated law school, raised a wonderful son, and spent her spare time traveling the world and exploring different countries and cultures.

When her friend Alberto Carballeira approached her about Living Benefits life insurance, she was hesitant at first. But after learning about how Living Benefits could allow her to access her death benefit while she was still living if she ever got sick, Elizabeth saw the value in it and put a policy in place for herself.

She had no idea how fateful that wise decision would prove to be.

The Johnstons

Jim Johnston was healthy – he surfed, he golfed, and was active. He had no reason to think he was going to get diagnosed with cancer. When he discovered a lump under his jawline while shaving, his world was changed in an instant.

Watch as Jim and his wife Anne relive his unexpected throat cancer diagnosis, and how his Living Benefits life insurance policy ultimately saved them from financial disaster.

Dorothy Ferguson

Dorothy Ferguson had no idea when she bought her policy that she would soon face a life-or-death battle with breast cancer. Listen to how Alliance Group’s Living Benefits helped Dorothy pay for her treatments when her health insurance couldn’t, and make a full recovery as a result.

The Shockleys

Alliance Group policyholders Devan and Cathleen Shockley were stunned to learn that Devan had developed malignant melanoma in his calf, and that it had spread to his lymph nodes. To their vast relief, Living Benefits were available on Devan’s life insurance policy, and they were able to accelerate his death benefit to pay for his treatments and other medical bills en route to a full recovery.

The Butlers

When Elliott Butler suffered a heart attack out of the blue, it was a huge shock to his wife Kathy. Even though they had enjoyed a substantial family income, Kathy soon found herself having to work a second job to make ends meet. It wasn’t until she received a timely reminder about the Living Benefits on her Alliance Group life insurance policy that Kathy found the financial relief her family needed – and just in the nick of time.

The Dudleys

Sophia Dudley was young, healthy, and had just given birth to her and husband Carlton’s fourth child. Life was good – until Sophia was shopping at the local supermarket and suffered three consecutive heart attacks. In an instant, this two-income family dropped to a zero-income family, as Carlton had to take off work to care for Sophia and their children. Listen as the Dudleys describe what Alliance Group was able to do for them, and how Living Benefits saved them from financial disaster.

Ronald Webb

When Ronald Webb bought a mortgage protection plan through Alliance Group in 2005, he had no idea how crucial that decision would prove to be a few short years later. After being diagnosed with lung cancer, Ron soon found himself struggling to pay for the hospital bills that were stacking up. Living Benefits allowed him to get much-needed cash in his hands that kept his financial household in order while he got the treatment he needed to make a full recovery.

Robert Curry

Robert Curry is a military veteran, father, and husband. He purchased life insurance coverage from National Life Group (an Alliance Group carrier) in order to leave a legacy behind for his family in case he passed away unexpectedly. His plan was to live until age 100 – but an unexpected ALS diagnosis changed Robert’s plans in a hurry. Living Benefits allowed him to retire immediately and take care of some bucket list items that had previously been relegated to the back burner.

Jessica’s Story

Jessica and her husband were on top of the world – they had just welcomed their second child, Mason, into the world, and life was good. On September 26th, 2011, Jessica received a call that would change their lives forever. The grim diagnosis: breast cancer. Thankfully, Jessica had covered herself with Living Benefits a few years before. Watch how that decision completely changed their family’s financial outlook, and led to a full recovery for Jessica and her family.

Linda Maxwell

As a person living with mild multiple sclerosis, Linda knew that being covered with sufficient life insurance was a wise decision. She had no idea that her MS symptoms would soon intensify, leaving her partially paralyzed and totally blind. Living Benefits allowed her to get the treatment she needed to stabilize her symptoms. Linda was even able to use some of the money to pay for her daughter’s cancer treatments as well.

Dave Disco

Dave Disco lives in Tulsa, Oklahoma with his wife and five children. When he experienced two heart attacks within two weeks, including the two life flight helicopter rides that went with them, he quickly found himself in dire financial straits. Over $150,000 worth of bills piled up in a matter of days. Luckily, Dave was protected with Living Benefits, and was able to accelerate $289,000 from his policy to help pay for those costs.

Joven & Benita

Joven and his wife Benita were living the American Dream until Joven was diagnosed with renal cell carcinoma of his left kidney – cancer. Benita was devastated, and went on a leave of absence from her nursing job to take care of her sick husband. Thankfully, Living Benefits allowed her to take the time off work to nurture her husband back to health. That money also helped pay for all of the treatment that Joven required on his way to a full recovery.